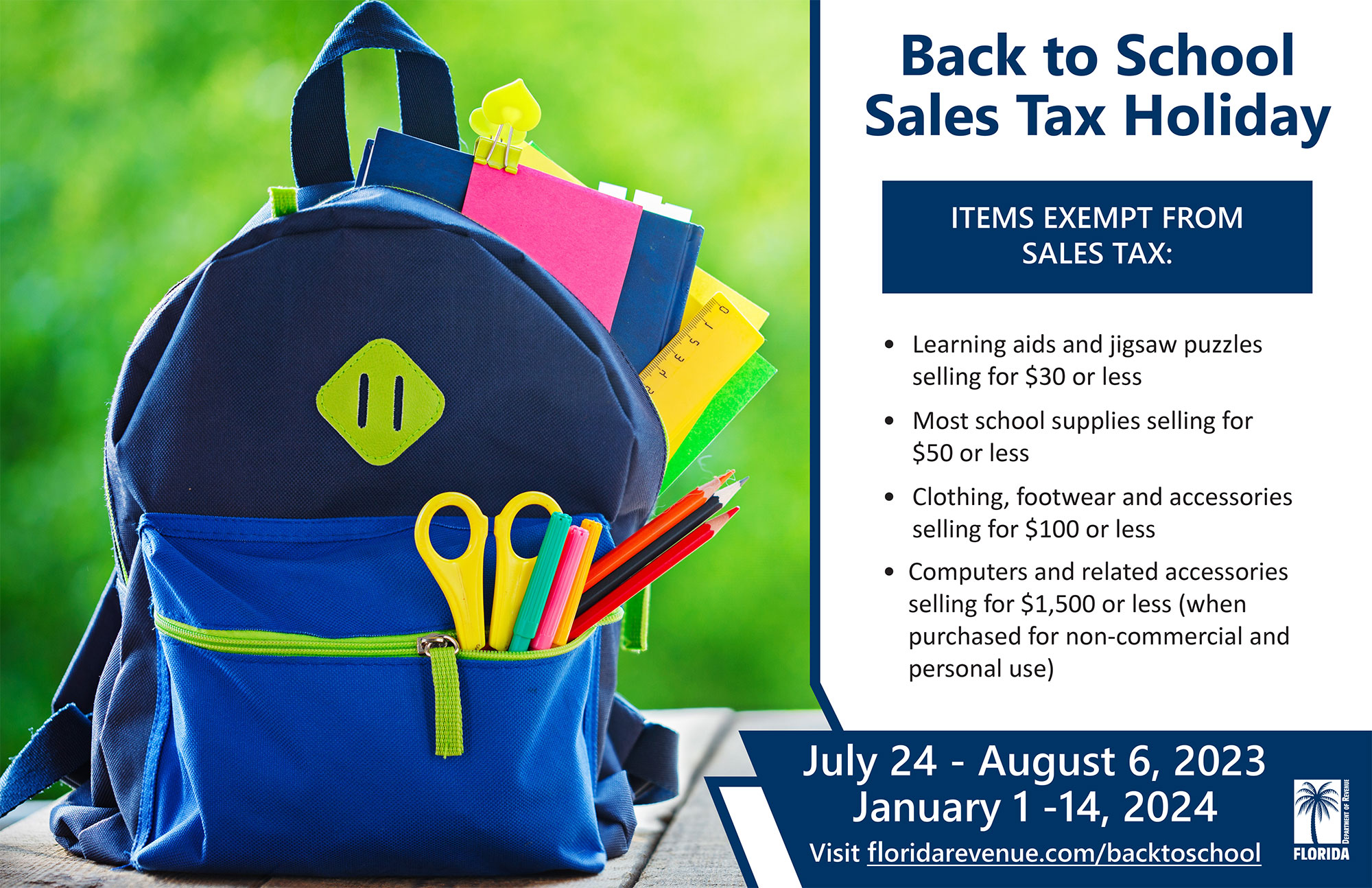

TALLAHASSEE ‒ Beginning Monday, July 24, and running through Sunday, Aug. 6, Florida families can save taxes on clothing, footwear, backpacks, school supplies, personal computers, and more. The traditional tax holiday has expanded this school year to include a second tax-exempt period from January 1 through January 14, 2024.

Frequently Asked Questions for Consumers

1. What items will be exempt from sales tax during the 2023 and 2024 Florida Back-to-School Sales Tax Holidays?

During the 2023 and 2024 Florida Back-to-School Sales Tax Holidays, certain clothing, footwear, and accessories with a sales price $100 or less per item, certain school supplies with a sales price of $50 or less per item, learning aids and jigsaw puzzles with a sales price of $30 or less, and personal computers and related accessories purchased for noncommercial home or personal use with a sales price of $1,500 or less, are exempt from sales tax. The 2023 tax holiday begins on Monday, July 24, 2023, and ends on Sunday, August 6, 2023; the 2024 tax holiday begins on Monday, January 1, 2024, and ends on Sunday, January 14, 2024.A list of items that are exempt from tax during the 2023 and 2024 Back-to-School Sales Tax Holidays is provided in TIP No. 23A01-06. These include:

• Personal computers or personal computer-related accessories purchased for noncommercial home or personal use having a sales price of $1,500 or less:

o Personal computers* include:

Electronic book readers

Laptops

Desktops

Handhelds

Tablets

Tower computers

* The term does not include cellular telephones, video game consoles, digital media receivers, or devices that are not primarily designed to process data.

o Personal computer-related accessories* include:

Keyboards

Mice

Personal digital assistants

Monitors

Other peripheral devices

Modems

Routers

Nonrecreational software, regardless of whether the accessories are used in association with a personal computer base unit

* The term does not include furniture or systems, devices, software, monitors with a television tuner, or peripherals that are designed or intended primarily for recreational use.• Items having a sales price of $100 or less per item:

o Wallets or bags*, including

Handbags

Backpacks

Fanny packs

Diaper bags

* Briefcases, suitcases, and other garment bags are excluded.

o Clothing

Any article of wearing apparel intended to be worn on or about the human body, excluding watches, watchbands, jewelry, umbrellas, and handkerchiefs

All footwear, excluding skis, swim fins, roller blades, and skates

• School supplies having a sales price of $50 or less per item:

o Pens

o Pencils

o Erasers

o Crayons

o Notebooks

o Notebook filler paper

o Legal pads

o Binders

o Lunch boxes

o Construction paper

o Markers

o Folders

o Poster board

o Composition books

o Poster paper

o Scissors

o Cellophane tape

o Glue or paste

o Rulers

o Computer disks

o Staplers

o Staples used to secure paper products

o Protractors

o Compasses

o Calculators

• Learning aids and jigsaw puzzles having a sales price of $30 or less:

o Flashcards or other learning cards

o Matching or other memory games

o Puzzle books and search-and-find books

o Interactive or electronic books and toys intended to teach reading or math skills

o Stacking or nesting blocks or setsPlease note: The 2023 Florida Back-to-School Sales Tax Holiday overlaps with the 2023 Florida Freedom Summer Sales Tax Exemption Period (taking place Monday, May 29, 2023, through Monday, September 4, 2023), which includes tax exemptions on several similar products. During the Florida Freedom Summer Sales Tax Holiday, the retail sale of various children’s toys and children’s athletic equipment is tax-exempt, as is the first $35 of the sales price of pool toys. See TIP No. 23A01-03 for specific information.

2. If I purchase an item that costs more than the limits stated above, do I only owe sales tax on the portion of the price that exceeds the limit for that item?

If you purchase an item that would otherwise qualify for the sales tax exemption but costs more than the limits listed above, the item is not exempt, and you must pay sales tax on the entire price of the item.3. Is there a limit on the number of items that can be purchased exempt during the sales tax holiday?

No. The exemption is based on the sales price of each item, not on the number of items purchased.4. How exactly are learning aids defined?

“Learning aids” are flashcards or other learning cards, matching or other memory games, puzzle books and search-and-find books, interactive or electronic books and toys intended to teach reading or math skills, and stacking or nesting blocks or sets. Examples of tax-exempt learning aids are the following items with a sales price of $30 or less per item:• Electronic books

• Flashcards

• Interactive books

• Jigsaw puzzles

• Learning cards

• Matching games

• Memory games

• Puzzle books

• Search-and-find books

• Stacking or nesting blocks or sets

• Toys that teach reading or math skills5. What types of items are not exempt?

The 2023 and 2024 Florida Back-to-School Sales Tax Holidays do not apply to:

• Any item of clothing with a sales price of more than $100;

• Any school supply item with a sales price of more than $50;

• Learning aids and jigsaw puzzles with a sales price of more than $30;

• Books that are not otherwise exempt;

• Computers and computer-related accessories with a sales price of more than $1,500;

• Computers and computer-related accessories purchased for commercial purposes;

• Rentals of any eligible items;

• Repairs or alterations of any eligible items; or

• Sales of any eligible items within a theme park, entertainment complex, public lodging establishment, or airport.6. If I buy a package or set of items that contains both taxable and tax-exempt items during the Back-to-School Sales Tax Holidays, how is sales tax calculated?

If a tax-exempt item is sold in a package with a taxable item, sales tax must be calculated on the sales price of the entire package or set.7. If the store is offering a “buy one, get one free” or “buy one, get one for a reduced price” special on coats and I purchase one for $200 and get another for free, will the transaction be tax-free because I am effectively paying $100 for each pair?

No. The total price of items advertised as “buy one, get one free” or “buy one, get one for a

reduced price” cannot be averaged for both items to qualify for the exemption. In this case, the purchase of the coats is taxable.8. If I purchase a gift card during the sales tax holiday, can I then purchase a qualifying item tax- exempt using the gift card after the tax holidays end?

No. The purchase of the qualifying item must be made during the sales tax holidays to be tax- exempt. However, when qualifying items are purchased during the tax holidays using a gift card, the items are tax-exempt; it does not matter when the gift card was purchased.9. If a store issues me a rain check during the sales tax holiday, can I use it after the sales tax holidays to purchase the item tax-exempt?

No. The purchase of the qualifying item must be made during the sales tax holidays to be tax- exempt. When a rain check is issued, a sale has not occurred. The sale occurs when the rain check is redeemed and the item is purchased.10. If I place an item on layaway, is it eligible for the tax exemption during the sales tax holiday? Yes. A layaway is when an item is set aside for a customer who makes a deposit, agrees to pay the balance of the purchase price over a period of time, and receives the merchandise at the end of the payment period. Qualifying items placed on layaway during the sales tax holidays are tax- exempt, even if final payment of the layaway is made after the tax holidays. If a customer makes a final payment and takes delivery of the items during the tax holiday, the qualifying items are tax- exempt.

11. Do the Back-to-School Sales Tax Holidays also apply to items I purchase online?

Yes. Items purchased online are exempt when the order is accepted by the company during the sales tax holidays for immediate shipment, even if delivery is made after the tax holidays.12. I purchased an exempt item during the sales tax holiday period, but the seller charged sales tax. How can I get a refund for the tax I paid?

You should take your receipt to the selling dealer and request a refund of the tax collected in error. If the dealer does not issue the refund, you may report this tax violation to the Department of Revenue.13. Who is responsible for determining which items are exempt and which aren’t?

The 2023 and 2024 Back-to-School Sales Tax Holidays are established through the lawmaking authority of the Florida Legislature. Sales tax holidays, and the items exempted by them, must be passed into law by the Legislature.14. How can I request that a certain type of product be added to the list?

Sales tax holidays, and the items exempted by them, are passed into law by the Florida Legislature. You may wish to contact your local representative regarding your suggestion. You can find your representative at www.myfloridahouse.gov.15. I didn’t see my question listed here. Where can I find additional information about the 2023 and 2024 Florida Back-to-School Sales Tax Holidays?

If you have a question about a specific item that is not listed in TIP No. 23A01-06, contact the Florida Department of Revenue at (850) 488-6800.16. I heard there were several sales tax holidays this year. Where can I find more information about the other holidays?

House Bill 7063 from the 2023 regular legislative session was signed into law on May 25, 2023. The new law contains six tax relief holidays and specifies the timeframe for each holiday. For a printable calendar of the tax relief holidays, you can visit our website: Florida Dept. of Revenue - Tax Holidays and Exemption Periods (floridarevenue.com)# # #

Email editor@

alachuatoday.com

Florida Back-to-School Sales Tax Holidays Start July 24

Tools

Typography

- Font Size

- Default

- Reading Mode