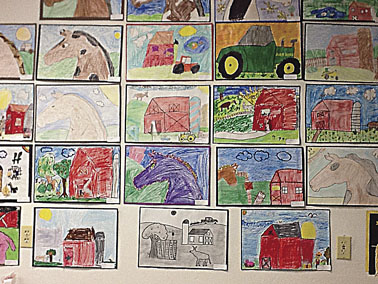

Photo special to Alachua County Today

This collection of pieces showcases farm life in Florida, this year's theme for the art show Around 150 students had their art on display.

NEWBERRY – Artwork from more than 150 young students is on display, as it has been for the past two weeks, at the Newberry Firehouse Gallery.

Newberry Elementary School students ranging from kindergarten through the fourth grade submitted their best artwork depicting the world they see around them. The pictures will be judged not only on the artistic quality of the work for their age group, but also on the ability of the artist to capture the theme of this year’s Lions Club competition, which is farm life in Florida.

Susan Ling, Newberry Elementary School art teacher, said she was amazed by the number of students who participated this year.

“I expected maybe 80 submissions,” she said. “I lost track after 130.” The actual count was 152, said the Lions Club president, Jack Varnon.

Each artist’s submission was mounted by Ling onto multi-colored backing and was submitted for showing at the art gallery. The gallery is open daily from 10 a.m. to 7 p.m. Newberry Main Street Organization’s Dallas Lee and Barbara Hendrix, the executive director, along with Amy Dalusio, spent an entire day hanging all of the artwork to make it possible for viewers to visit the gallery and see all of the children’s entries.

Awards will be given out to participants from 10 a.m. to noon on Saturday, Feb. 15 at the Firehouse Gallery. Monetary awards in varying amounts will be given to students winning “best in show” and the first and second place winners in each of the grades. In addition, a purple rosette will be given out to the grand prize winning student whose work best epitomizes the theme.

Past Lions Club president Mindie Fortson will provide the criteria for judging to the panel of five judges made up of from citizens of Newberry.

Varnon said the annual competition has been a part of the Newberry Lions Club annual Farm Toy Show and Tractor Parade in past years. Although Lions Club members did not produce the toy show this year, they decided to sponsor this aspect of their usual show as a way to encourage young artists to display their talents and share their work with the Newberry community.

“I am very excited for our students to have this opportunity to participate in an art show in their own home town that relates to elements of their daily life,” said principal Ling. “There are people in our community that want to see our students succeed and show off their many talents. We could not have done such a fine show without the sponsorship of The Lions Club and the willingness of the Firehouse Gallery to host the event.”

Although the Newberry Lions Club membership has dwindled in past years as members moved away or became incapacitated, Varnon said the organization is looking for new members.

“We’re hoping to identify those community leaders who feel as we do that service is a privilege and an honor,” Varnon said. The group is hoping to recruit like-minded individuals and restore the Lions Club to the viable service group that it used to be. “This Florida Farm Art Show is one way we hope to serve our community and encourage our youth at the same time,” Varnon said.

# # #

Email cwalker@

alachuatoday.com

Add a comment