TALLAHASSEE – Today, Florida TaxWatch (FTW) is releasing an economic commentary entitled An Update on Florida’s Housing Rental Market. The report builds on previous FTW commentaries, Beyond the Pandemic: Long-term Changes and Challenges for Housing in Florida (October 2021) and Too Expensive to Rent: Florida’s Rental Market and Eviction Moratorium (March 2022), to examine the current strain on Florida’s rental market and the resulting price growth. FTW notes that the circumstances, which are being experienced across the state, are the consequence of Florida’s significant population growth, a decade of slow housing construction, and a post-COVID-19 housing boom.

Florida TaxWatch President and CEO Dominic M. Calabro said, “Florida is the best state in the nation to live, work, and play, and over 800 new residents arriving every single day is proof positive. But having the fastest-growing population in the nation doesn’t come without challenges, particularly when it comes to attainable housing.

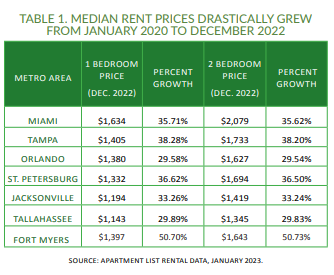

“Supply and demand pressures help explain the recent surge in housing and rental prices. More and more, would-be homebuyers are choosing to rent, which has placed further pressure on the state’s rental market and subsequently caused price spikes. In fact, there has been a 36 percent increase from January 2020 to December 2022 alone, adding burden to household budgets that were already straining from inflation.

“Thankfully, preliminary forecasts suggest relaxed rental demand and additional supply that will ease price growth in the coming months. But that still doesn’t mean existing prices will decrease, and it can be expected that individuals and families throughout Florida will continue to grapple with housing affordability well into 2023.

“Housing is heavily intertwined with Florida’s success. Florida TaxWatch thanks Senate President Kathleen Passidomo, House Speaker Paul Renner, and the Florida Legislature for prioritizing this challenge, and we look forward to working with them to identify real, effective solutions on behalf of all Floridians during the upcoming session.”

According to the U.S. Census Bureau, about 2.5 million Floridians were occupying rental units in 2019, and an additional 100,000 residents were renting in 2021. FTW writes that this increase is actually a sign of a strong economy, as those who lived with family or friends are now financially equipped to live on their own, and residents from other states are being attracted to the gainful employment offered here.

In Florida’s metropolitan areas, such as Miami, Tampa, and Fort Myers, median rent prices have drastically increased since 2020, which FTW contends is the result of these cities’ popularity among job seekers in general, but especially remote workers.

In fact, rent prices have grown so much that they surpassed the prices predicted by historical trends. According to one index cited by FTW, of the 25 most overvalued rental markets nationwide, with costs ranging from 7.06 percent to 18.05 percent higher than predictions, Florida is home to nine: Cape Coral (#1), Miami (#2), North Port (#3), Tampa (#7), Orlando (#12), Deltona (#14), Palm Bay (#16), Jacksonville (#18), and Lakeland (#21).

Moreover, FTW notes that housing advocates suggest that the price of rent is often considered affordable when it costs 30 percent or less of a household’s income, and when it costs more, the household is cost burdened. With the state’s average median income (AMI) coming in at about $61,777, most households earning the AMI or less are cost burdened, paying 40 percent or more of their household income on rent, though many households often have more than one earner, making it more attainable if housing stock were available.

FTW asserts that there are multiple contributing factors to Florida’s high rent, including the slowed construction of both houses and rental units. Construction has steadily risen since the Great Recession of 2008, with 213,000 units under construction in 2021, though this number could have been higher but for supply chain disruptions caused by the pandemic.

For more information and to access the full report, please click here.

About Florida TaxWatch

As an independent, nonpartisan, nonprofit government watchdog and taxpayer research institute for more than forty years and the trusted eyes and ears of Florida taxpayers, Florida TaxWatch works to improve the productivity and accountability of Florida government. Its research recommends productivity enhancements and explains the statewide impact of fiscal and economic policies and practices on citizens and businesses. Florida TaxWatch is supported by its membership via voluntary, tax-deductible donations and private grants, and does not accept government funding. Donations provide a solid, lasting foundation that has enabled Florida TaxWatch to bring about a more effective, responsive government that is more accountable to, and productive for, the citizens it serves since 1979. For more information, please visit www.floridataxwatch.org.# # #

Email editor@

alachuatoday.com

Florida TaxWatch Releases Update on Florida’s Housing Rental Market

Tools

Typography

- Font Size

- Default

- Reading Mode

Jennifer Breman, a career and technical education program specialist with Alachua County Public Schools, has been elected to serve on the Board of Directors of the Association for Career and Technical Education (ACTE), the nation’s largest nonprofit organization dedicated to advancing career and technical education.

Jennifer Breman, a career and technical education program specialist with Alachua County Public Schools, has been elected to serve on the Board of Directors of the Association for Career and Technical Education (ACTE), the nation’s largest nonprofit organization dedicated to advancing career and technical education.

Using an inhaler seems straightforward, but it’s actually a high-precision task. If the technique isn't quite right, the medication often ends up hitting the back of your throat instead of reaching your lungs where it’s needed.

Using an inhaler seems straightforward, but it’s actually a high-precision task. If the technique isn't quite right, the medication often ends up hitting the back of your throat instead of reaching your lungs where it’s needed.